"They saw what no one else could see." And they pocketed billions for knowing about money in a way that no one was talking about. The Big Short, based on a book by Michael Lewis that framed the 2007 financial crisis as a thriller, has recently become a holiday hit, holding its own against that other December blockbuster Star Wars: The Force Awakens. If the film The Big Short teaches us anything, it instructs all Americans about the value of improving their financial literacy.

Money talks. And, if educators and parents agree about one key to a well-rounded education, it's the importance of having "money talks" with our young people. The latest generation to enter adulthood, the Millenials, are facing some of history's toughest financial challenges while also experiencing some of its greatest opportunities for financial well being. That is why I am always impressed when my students enroll in our school's economics and business finance classes. Like all young people, they can always use help. And that is why I am happy to announce and proud to support H&R Block who is once again promoting financial literacy to young people and supporting that goal with direct support to the nation's classrooms.

- Experience real life as an adult: paying bills, managing expenses, saving money, investing in retirement, paying taxes and more.

- Sit in the "drivers’ seat" as they immerse into the financial life of a recent college graduate who has been working for about six months.

- Receive a regular paycheck, a checking account, a 401(k) savings account, and bills to pay throughout the simulation. By maximizing 401(k) savings, paying bills on time and responding correctly to quiz questions while avoiding fees like late fees, overdraft fees and finance charges, students increase their individual score.

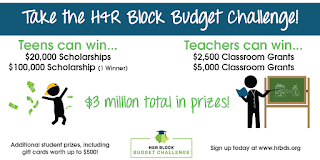

The H&R Block Budget Challenge is a great opportunity for schools and students alike because lesson plans and classroom materials are readily available. And, best of all, the program is FREE. There's no better financial decision than to take advantage of free opportunities, and in an era of ever-tightening classroom budgets, teachers will be happy to learn they can access these opportunities for no cost to themselves or their school. And, most importantly, in addition to the free experience and knowledge, students can EARN BIG CASH. $3 million in cash and scholarships are available to participants.

Learning how to manage a check book or decipher credit card offers was a mystery to me as a young adult. That's why I like to promote financial literacy to my students, encouraging them to learn about concepts such as compound interest and "saving 10%" of what they earn. As I approach middle age and consider my financial future, I wish I could have had some practice making adult financial decisions before I was actually an adult and risking my own money. That's why I really appreciate our high school social studies teachers who make economics and personal financial literacy a part of their standard curriculum. Teachers who take advantage of offerings like H&R Block's Budget Challenge have the greatest impact on their students by using a game and the spirit of competition to engage young people with possibly the most important and immediately useful information they'll learn in school - the ability to manage their financial lives.

And, lest you think, there are no real winners, check out this video of a St. Clair High School senior who thought he won a $20,000 scholarship, only to learn he actually won the grand prize of $120,000:

Clearly, dreams come true and hard work pays off. And, there's no reason to sit this one out. The Challenge is open to any full-time students age 14 and older whose teacher registers them. The deadline for this latest round is January 7, with class creation deadlines rolling through February 4, so you have some time, but there is no time to waste. Start the semester off right by encouraging your teachers and classmates to enter the H&R Block Budge Challenge. Participating teachers can get $15 off their tax preparation just by downloading the lesson plans.

I have trusted my tax returns to H&R Block for years, and I firmly believe in the guidance they provide. Join H&R Block in its quest to promote financial literacy. It just makes sense.

** “This is a sponsored post on behalf of We Are Teachers and H&R Block. I received compensation for this post, however all opinions stated are my own.”

No comments:

Post a Comment